Directors close businesses for many reasons, so there has to be a range of liquidation and company closure options to suit all requirements. One form of liquidation is a member’s voluntary liquidation, which involves a declaration of solvency. In this article, we’re answering the question – what is a declaration of solvency?

Why do directors choose to close limited companies?

There are many reasons why directors choose to close their limited companies. These can include money troubles, retirement or beginning a new venture. They may also include directors who simply don’t want to run the business anymore.

If your business is becoming insolvent, it’s essential to seek advice as soon as possible. Seeking advice early will give you more options to consider for closing the business.

Insolvency vs solvency meaning

An insolvent business typically cannot pay debts when they fall due. As a result, your business liabilities will be worth more than your company’s assets, which means there may be little value left in the company.

On the contrary, a solvent company can afford to pay off debts and may not be closing due to debt problems.

How do you close a solvent company?

Before you decide to close your company, you need to establish whether it is solvent or insolvent. This will allow you to evaluate the options available to you.

- Can you pay your business debts on time?

- Are your company assets worth more than your liabilities?

- Are there any legal proceedings in place against your company? (CCJs, statutory demands etc.)

If your business is solvent, you would have answered yes, yes, no to these questions.

Once you’ve established that your business is solvent, you can decide whether you would like to strike off the company or enter a member’s voluntary liquidation.

Striking off a company

A company strike-off can only be used by companies with no outstanding debts. Companies that attempt to use a strike-off with debts may be refused or may end up being personally liable for business debts.

A strike-off can often be referred to as dissolution. It is a straightforward way of closing a business and can be completed on the Companies House website. All you need to do is complete a DS01 form for £10. Once the application for closure is received, your business is advertised in the London Gazette with the intention of striking it off. If no one objects to the striking-off within three weeks, the company can be successfully closed.

Using a Members Voluntary Liquidation

The member’s voluntary liquidation process is initiated by a company director but must be agreed to by other company shareholders. It is a solvent liquidation, whereby you can pay off company debts. If you have outstanding debts, but your assets are worth more, these can be sold to pay back any company creditors. Find out who gets paid first in a liquidation.

Your insolvency practitioner will handle the payments to creditors. You must appoint a licensed insolvency practitioner to take care of your liquidation process.

A member’s voluntary liquidation can only be used by a solvent company. Insolvent companies would be required to complete a voluntary liquidation or wait until they are forced into a compulsory liquidation through a winding-up resolution.

What is a declaration of solvency?

A declaration of solvency is required when entering a member’s voluntary liquidation. It is a sworn declaration that states that the business in question can afford to pay off all creditor debts.

Directors must consider any interest that will be accrued during this time. The statutory declaration states that business debts and interest will be paid off within 12 months.

Depending on the number of directors a company has, more may be required to sign the declaration. The statutory declaration shows that the directors have considered the closure and any outstanding debts. It proves that directors believe these can be settled based on the company’s financial position and business affairs.

The declaration of solvency must be taken seriously, as it is a very important legal document. Making a false declaration with no evidence is a criminal offence and could land you in trouble with fines or other issues, as stated within the Insolvency Act 1986. A full enquiry would be completed into the company’s financial position.

The declaration is the responsibility of the company director or directors of the business, not the insolvency practitioner. The insolvency practitioner’s role is to ensure everyone receives a fair outcome and assist with the facilitation of the company closure.

You must complete the declaration of solvency within the relevant time frame specified. Once the declaration of solvency is complete, it is sent to Companies House by the practitioner you have appointed for the solvency procedure.

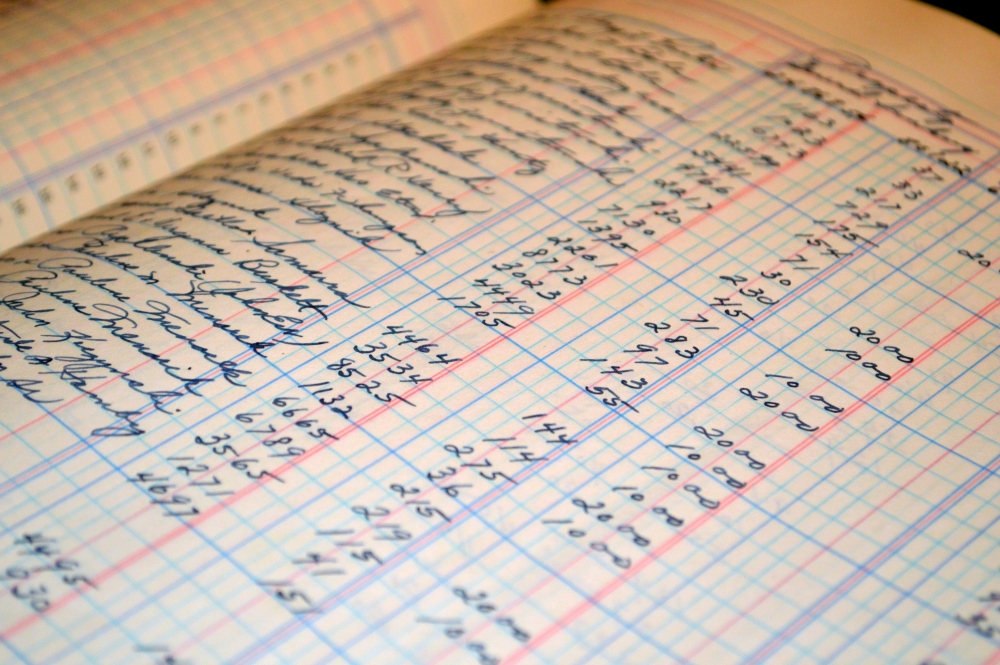

Some directors struggle to get information together for their declaration of solvency. This task can be made much easier if you have access to up-to-date accounts and are aware of your financial position.

An external valuer must be employed to assess your company’s assets. This helps to avoid bias or the sale of assets under or over-value.

What is a solvency statement?

A solvency statement is the same as a declaration of solvency. It is used to confirm that a company can afford to pay off all debts within a specified period of time. The statement includes an outline of the company’s assets and liabilities.

How much is a member’s voluntary liquidation?

A member’s voluntary liquidation is usually around the £4000 (+ VAT) mark. This may be less than a creditor’s voluntary liquidation (CVL), as there can be less work involved for the insolvency practitioner.

We recommend that you are wary of cheap liquidation costs, as these can often be too good to be true. We often hear from directors who chose the cheapest option and now pay thousands more than the original price. You should also get all liquidation pricing in writing so that you have evidence if you need it at a later date.

We hope this article has been useful on the statutory declaration of solvency and are happy to offer any advice to directors regarding the liquidation process. We can also offer advice on entrepreneurs’ relief during a member’s voluntary liquidation.

Youtube - 1st Business Rescue

Please get in touch and we’ll come back to you

without delay.

Call 0808 506 2246

Text 07717 738 167

Complete a Free Online Enquiry